Qualifications

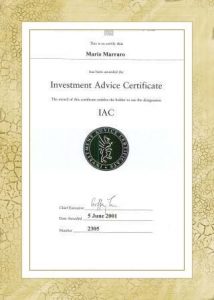

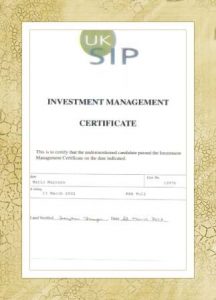

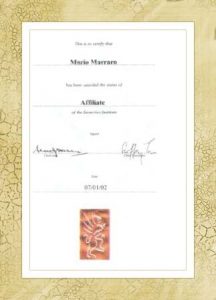

Mario Marraro was born in Jersey, Channel Islands, and worked for Chase Manhatten, Deutsche Bank and ABN Amro in the foreign exchange and portfolio management area during his early banking carrer. After joining UBS AG as a Senior Account Officer in the Private Banking area, he qualified as an investment advisor as per the Financial Services Authority (FSA) requirements.

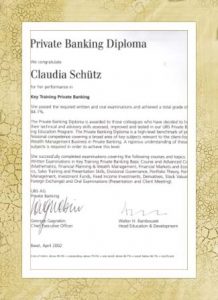

Claudia Schuetz, born in Switzerland, began her banking career at UBS AG in Switzerland as a client advisor. She relocated to Jersey in 1995 and was a Senior Account officer at UBS AG Jersey in the Private Banking area for Swiss Nationals. She is an FSA qualified investment advisor and fluent in English, German and French.

Please find copies of our professional qualifications below.

The banks offer mortgages for acquisition, construction and equity release.

The most common types of mortgages are on a capital repayment basis with a variable or fixed interest rate.

For an indication of the monthly cost of the required mortgage, please consult our mortgage calculator.

The only additional cost will be the building insurance premium. Building insurance is required by all lenders and cover for fire and flood is mandatory.

Some lenders also require life insurance cover. We will advise of such a requirement when providing you with the initial simulations.

For a detailed list of the required documentation please click here.

Most banks offer a maximum mortgage term of 50 years for Portuguese residents and 30 years for non-residents.

The maximum age upon maturity of the mortgage is generally 80 for residents and 75 for non-residents.

Mortgages can be repaid early at any time during the loan term.

The early redemption penalty for a variable acquisition mortgage is 0.50% (as per the rule of the Bank of Portugal) and 2% for a fixed rate mortgage.

The interest rates of a Portuguese variable rate mortgages is linked to either the 3 or 6 month Euribor rate and increased by the margin (spread) that the bank applies.

This Euribor rate is set by a panel of European banks on a daily basis and is generally an indicator as to what rate European banks will lend to each other at (in the UK they use the London inter bank offer rate (LIBOR). Euribor rates can be accessed on the following site www.euribor-rates.eu/

In the case of the three month Euribor rate, your mortgage repayments will be fixed for three months at the prevailing rate at the day you sign the mortgage deed, thereafter, every three months later the bank will apply the average rate of the three month Euribor rate to your mortgage from the previous month.

The interest rate margin (spread) will be confirmed on the day the mortgage is approved and will be fixed for the term of the loan.

The bank will lend up to 80% of the lower of the valuation price or the purchase price of your chosen property. The mortgage approval will be based on various affordability ratios that the banks apply.

The bank will require proof of your income as per your latest tax return / P60 and a credit report for confirmation of existing liabilities. As a rule of thumb, 30% of your net income can be attributed to mortgage repayments (including the new mortgage in Portugal).

Building insurance

Building insurance is a mandatory requirement when taking out a Portuguese mortgage. The minimum cover required is generally against fire and floods. The insurance premium will be based on the re-construction value of the property.

Life insurance

Some banks require life insurance cover for either the main applicant or both mortgage applicants. We will advise you of such a mandatory requirement when providing you with the mortgage proposal document.

If life insurance is not required by the chosen lender you may wish to arrange such cover in your home country.

Content insurance

Content insurance is not mandatory when obtaining a mortgage but should be arranged when taking possession of your property.

Public liability cover

Public liability cover should be considered when intending to rent out the property. Public liability cover is an optional cover under the content insurance.